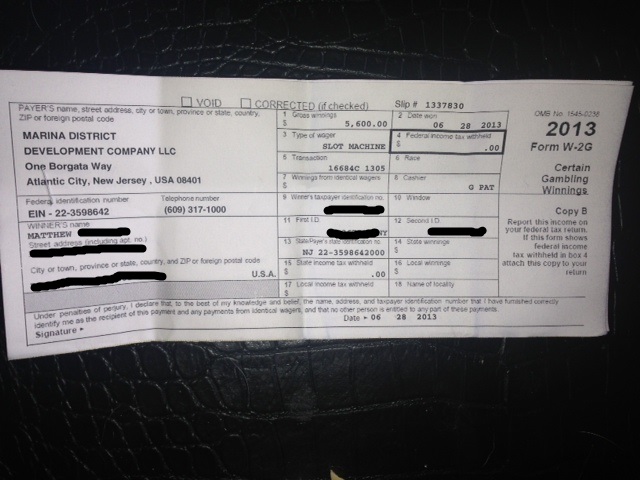

You cannot deduct more in gambling losses than you report in gambling winnings on your federal income tax return. Also, you must be able to prove the amount of your losses with the records noted above. To deduct gambling losses, complete Schedule M1SA, Minnesota Itemized Deductions. Include Schedule M1SA when you file Form M1, Individual Income. If you claim a gambling loss deduction, you will have to prove that you are entitled to it. Casinos send a form W-2G when you win to let the IRS know that they paid you, but it's up to you to establish your losses. The IRS requires you to keep tickets or receipts and a diary of your winnings and losses to substantiate your deduction. Gambling Losses To claim your gambling losses, you have to itemize your deductions. Gambling losses are a miscellaneous deduction, but - unlike some other miscellaneous deductions - you can. Unfortunately for gamblers, casinos, race tracks, state lotteries, bingo halls, and other gambling establishments located in the United States are required to tell the IRS if you win more than a specified dollar amount. They do this by filing a tax form called Form W2-G with the IRS. You're given a copy of the form as well.

On Tax Form 1040, simply total your sports betting winnings and put that figure in the 'Other Income' spot. This is line 21 of form 1040. You can report your losses as an itemized deduction. These deductions are reported on your Schedule A form. You will pay taxes on your net winnings (or your wins minus your losses). This means that if you.

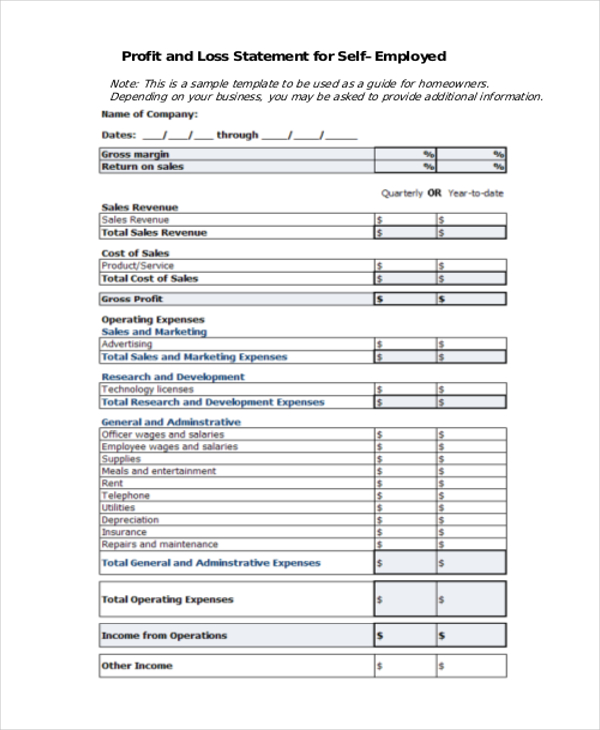

By Alistair M. NeviusProfessional gamblers are treated differently from amateur gamblers for tax purposes because a professional gambler is viewed as engaged in the trade or business of gambling. The professional gambler reports gambling winnings and losses for federal purposes on Schedule C, Profit or Loss From Business. To compute his or her business income, the professional gambler may net all wagering activity but cannot report an overall wagering loss. In addition, the taxpayer may deduct 'ordinary and necessary' business expenses (expenses other than wagers) incurred in connection with the business.

Whether a gambler is an amateur or a professional for tax purposes is based on the 'facts and circumstances.' In Groetzinger, 480 U.S. 23 (1987), the Supreme Court established the professional gambler standard: 'If one's gambling activity is pursued full time, in good faith, and with regularity, to the production of income for a livelihood, and is not a mere hobby, it is a trade or business.' The burden is on the gambler to prove this status.

In addition to applying the standard established in Groetzinger, courts sometimes apply the following nonexhaustive nine-factor test in Regs. Sec. 1.183-2(b)(1) used to determine intent to make a profit under the hobby loss rules to decide whether a taxpayer is a professional gambler:

- The manner in which the taxpayer carries on the activity;

- The expertise of the taxpayer or his advisers;

- The time and effort the taxpayer expended in carrying on the activity;

- An expectation that assets used in the activity may appreciate in value;

- The taxpayer's success in carrying on other similar or dissimilar activities;

- The taxpayer's history of income or losses with respect to the activity;

- The amount of occasional profits, if any, that are earned;

- The financial status of the taxpayer; and

- Elements of personal pleasure or recreation.

What if a professional gambler's 'ordinary and necessary' business expenses exceed the net gambling winnings for the year? In Mayo, 136 T.C. 81 (2011), the court held the limitation on deducting gambling losses does not apply to ordinary and necessary business expenses incurred in connection with the trade or business of gambling. Therefore, a professional gambler may report a business loss, which may be applied against other income from the year.

LIMITATIONS ON LOSS DEDUCTIONS

Some states do not permit amateur gamblers to deduct gambling losses as an itemized deduction at all. These states include Connecticut, Illinois, Indiana, Kansas, Massachusetts, Michigan, North Carolina, Ohio, Rhode Island, West Virginia, and Wisconsin. A taxpayer who has $50,000 of gambling winnings and $50,000 of gambling losses in Wisconsin for a tax year, for example, must pay Wisconsin income tax on the $50,000 of gambling winnings despite breaking even from gambling for the year.

Because professional gamblers may deduct gambling losses for state income tax purposes, some state tax agencies aggressively challenge a taxpayer's professional gambler status. A taxpayer whose professional gambler status is disallowed could face a particularly egregious state income tax deficiency if the taxpayer reported on Schedule C the total of Forms W-2G, Certain Gambling Winnings, instead of using the session method under Notice 2015-21. In this situation, the state may be willing to consider adjusting the assessment based on the session method if the taxpayer provides sufficient documentation.

For a detailed discussion of the issues in this area, see 'Tax Clinic: Taxation of Gambling,' by Brad Polizzano, J.D., LL.M., in the October 2016 issue of The Tax Adviser.

—Alistair M. Nevius, editor-in-chief, The Tax Adviser

The Tax Adviser is the AICPA's monthly journal of tax planning, trends, and techniques.

Also in the October issue:

- An analysis of executive compensation clawbacks.

- An update on recent developments in estate planning.

- A look at revisions to Forms 1042-S and W-8BEN-E.

AICPA members can subscribe to The Tax Adviser for a discounted price of $85 per year. Tax Section members can subscribe for a discounted price of $30 per year.

Author

Probability of a royal flush in texas holdemas hold em. Do you roll the dice? Enjoy the slot machines? Even as a casual gambler, your winnings are fully taxable and must be reported on your tax return. Learn more about how the Tax Cuts and Jobs Act impacts gambling.

There are unique considerations when it comes to disclosing gambling wins and losses on your tax return….modified recently under the Tax Cuts and Jobs Act (TCJA). If you gamble, make sure you understand the tax consequences.

First off—what counts as gambling in the eyes of the IRS?

Gambling income includes (but is not limited to)

- Winnings from

- Lotteries

- Raffles

- Horse races

- Casinos

- Cash winnings

- Fair market value of prizes (like cars and trips)

The general rules

Wins

You are required to report 100% of gambling winnings as taxable income on your 1040. In addition, all complimentary offerings provided by casinos and gambling establishments must also be included in winnings. Winnings are subject to your federal income tax rate (though rates have been reduced under the TCJA-check out our blog, 2018 Tax Reform Provisions for Individuals for more on this).

Also, if you receive a certain amount of gambling winnings or if you have any winnings that are subject to federal tax withholding, the payer must issue you a Form W-2G 'Certain Gambling Winnings'.

Hold your luck tight and join our users in the adventure to the world of free slots on SlotsSpot.co.uk. The Best choice of Free Slots to play for fun Only twenty years ago or so, slot games were available only in casinos and pubs, but the boost experienced by the gambling industry within the previous 10 years has opened many new possibilities. If you're looking for free online slots, there's no better place to search than here at VegasSlots.co.uk. Our team of industry experts has been playing slots for years, and we've used that knowledge to put together the best collection of free online slots for UK players in 2020. On our site, you can play. Free slots uk online. Welcome to the best place to play FREE online slots and video poker. Choose from 30+ totally FREE 3-reel and 5-reel slots. No installation or download needed, just.

In other words, the payer is required to issue you a W-2 G if you receive (according to the IRS).

- $1,200 or more in gambling winnings from bingo or slot machines;

- $1,500 or more in proceeds (the amount of winnings minus the amount of the wager) from keno (a game of chance similar to lotto);

- More than $5,000 in winnings (reduced by the wager or buy-in) from a poker tournament;

- $600 or more in gambling winnings (except winnings from bingo, keno, slot machines, and poker tournaments) and the payout is at least 300 times the amount of the wager; or

- Any other gambling winnings subject to federal income tax withholding.

Losses

Gambling losses can be written off as miscellaneous itemized deductions. The gambling loss deduction is limited to the extent of your winnings for the year and excess losses cannot be carried forward to future years.

Under the TCJA, misc. deductions subject to the 2% of adjusted gross income floor are not allowed, however certain deductions (including the gambling loss deduction) are still deductible.

However, since the standard deduction for 2018 was nearly doubled by the TCJA, many taxpayers may no longer benefit from itemizing, seeing as itemizing saves tax only when the total itemized deductions exceed the applicable standard deduction.

How do you claim a deduction for gambling losses?

Recordkeeping is key!

To deduct gambling losses, you must document:

LIMITATIONS ON LOSS DEDUCTIONS

Some states do not permit amateur gamblers to deduct gambling losses as an itemized deduction at all. These states include Connecticut, Illinois, Indiana, Kansas, Massachusetts, Michigan, North Carolina, Ohio, Rhode Island, West Virginia, and Wisconsin. A taxpayer who has $50,000 of gambling winnings and $50,000 of gambling losses in Wisconsin for a tax year, for example, must pay Wisconsin income tax on the $50,000 of gambling winnings despite breaking even from gambling for the year.

Because professional gamblers may deduct gambling losses for state income tax purposes, some state tax agencies aggressively challenge a taxpayer's professional gambler status. A taxpayer whose professional gambler status is disallowed could face a particularly egregious state income tax deficiency if the taxpayer reported on Schedule C the total of Forms W-2G, Certain Gambling Winnings, instead of using the session method under Notice 2015-21. In this situation, the state may be willing to consider adjusting the assessment based on the session method if the taxpayer provides sufficient documentation.

For a detailed discussion of the issues in this area, see 'Tax Clinic: Taxation of Gambling,' by Brad Polizzano, J.D., LL.M., in the October 2016 issue of The Tax Adviser.

—Alistair M. Nevius, editor-in-chief, The Tax Adviser

The Tax Adviser is the AICPA's monthly journal of tax planning, trends, and techniques.

Also in the October issue:

- An analysis of executive compensation clawbacks.

- An update on recent developments in estate planning.

- A look at revisions to Forms 1042-S and W-8BEN-E.

AICPA members can subscribe to The Tax Adviser for a discounted price of $85 per year. Tax Section members can subscribe for a discounted price of $30 per year.

Author

Probability of a royal flush in texas holdemas hold em. Do you roll the dice? Enjoy the slot machines? Even as a casual gambler, your winnings are fully taxable and must be reported on your tax return. Learn more about how the Tax Cuts and Jobs Act impacts gambling.

There are unique considerations when it comes to disclosing gambling wins and losses on your tax return….modified recently under the Tax Cuts and Jobs Act (TCJA). If you gamble, make sure you understand the tax consequences.

First off—what counts as gambling in the eyes of the IRS?

Gambling income includes (but is not limited to)

- Winnings from

- Lotteries

- Raffles

- Horse races

- Casinos

- Cash winnings

- Fair market value of prizes (like cars and trips)

The general rules

Wins

You are required to report 100% of gambling winnings as taxable income on your 1040. In addition, all complimentary offerings provided by casinos and gambling establishments must also be included in winnings. Winnings are subject to your federal income tax rate (though rates have been reduced under the TCJA-check out our blog, 2018 Tax Reform Provisions for Individuals for more on this).

Also, if you receive a certain amount of gambling winnings or if you have any winnings that are subject to federal tax withholding, the payer must issue you a Form W-2G 'Certain Gambling Winnings'.

Hold your luck tight and join our users in the adventure to the world of free slots on SlotsSpot.co.uk. The Best choice of Free Slots to play for fun Only twenty years ago or so, slot games were available only in casinos and pubs, but the boost experienced by the gambling industry within the previous 10 years has opened many new possibilities. If you're looking for free online slots, there's no better place to search than here at VegasSlots.co.uk. Our team of industry experts has been playing slots for years, and we've used that knowledge to put together the best collection of free online slots for UK players in 2020. On our site, you can play. Free slots uk online. Welcome to the best place to play FREE online slots and video poker. Choose from 30+ totally FREE 3-reel and 5-reel slots. No installation or download needed, just.

In other words, the payer is required to issue you a W-2 G if you receive (according to the IRS).

- $1,200 or more in gambling winnings from bingo or slot machines;

- $1,500 or more in proceeds (the amount of winnings minus the amount of the wager) from keno (a game of chance similar to lotto);

- More than $5,000 in winnings (reduced by the wager or buy-in) from a poker tournament;

- $600 or more in gambling winnings (except winnings from bingo, keno, slot machines, and poker tournaments) and the payout is at least 300 times the amount of the wager; or

- Any other gambling winnings subject to federal income tax withholding.

Losses

Gambling losses can be written off as miscellaneous itemized deductions. The gambling loss deduction is limited to the extent of your winnings for the year and excess losses cannot be carried forward to future years.

Under the TCJA, misc. deductions subject to the 2% of adjusted gross income floor are not allowed, however certain deductions (including the gambling loss deduction) are still deductible.

However, since the standard deduction for 2018 was nearly doubled by the TCJA, many taxpayers may no longer benefit from itemizing, seeing as itemizing saves tax only when the total itemized deductions exceed the applicable standard deduction.

How do you claim a deduction for gambling losses?

Recordkeeping is key!

To deduct gambling losses, you must document:

- The date and type of gambling activity

- The name and address of the gambling establishment

- The names of anyone who was present with you at the gambling establishment

- The amount won or lost

**You can document gambling on table games by recording the number of the table you played and retain statements showing casino credit issued to you. As far as lotteries go, you can use winning statements and unredeemed tickets as documentation.

Key takeaway

The TCJA adds limitations to the gambling loss deduction — you can now only deduct losses up to the amount of your winnings. Any excess loss cannot offset other highly taxed income. Thus, those in the trade or business of gambling, may no longer deduct non-wagering expenses, such as travel expenses or fees, to the extent those expenses exceed gambling gains.

Questions? Contact us.

What Form Do You Use For Gambling Losses

The TCJA…So Many Changes, So Many Questions…we can help you navigate this huge tax overhaul! Visit our Tax Reform Center for everything you and your business need to know, now. Poker night 2 drinks.

Newsletter

Get KLR updates delivered to your inbox.